is interest on your car loan tax deductible

Many taxpayers had feared that the new tax law the. This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction.

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Mortgage

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

. Mortgage interest is considered to be a personal expense and not a tax deduction. In short the answer is no. This means that mortgage interest you pay on your home loan cannot be deducted from the taxable income unlike property taxes.

Follow through the screens and determine whether actual vehicle expense or the standard mileage rate is a better option for your tax return. But you will need to keep accurate. Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. To the right of the Vehicle expenses click Edit. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

If on the other hand the car is used entirely for business purposes then the. One of the benefits of rideshare driving is you can deduct car loan interest from your taxes. When you get a car title loan with LoanMart we will.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. Now you may be wondering is driving to work considered. For example a sales professional who uses hisher personal car to meet with clients.

For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns. Your modified adjusted gross income is below 70000. This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction.

When repaying student loans interest is tax deductible provided that you do not file separately while being married. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid. The faster you pay off your car title loan the less you will pay in interest.

Common deductible interest includes that incurred by mortgages student loans and investments. Some of the documents to keep when claiming auto loan interest deduction on your tax return include. You need to determine the percentage of time the vehicle is driven for business versus personal needs and apply that calculation to the loan interest deduction claimed on your tax returns.

Answered on Dec 03 2021. When you file your taxes with the Internal Revenue Service IRS there are many rules about what can be deducted and how. If on the other hand the car is used entirely for business purposes the full amount of.

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Additionally under current tax law mortgage interest is only deductible up to 1 million of mortgage debt.

No personal driving will be included in these deductions. The interest on a car title loan is not generally tax deductible. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes. To do this you have to keep detailed records of these expenses and the miles you drive for business. Not all interest is tax-deductible including that which is associated with credit cards and auto loans.

To the right of the vehicle click Edit. Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income. What this means is you must be self-employed own a small business or use a vehicle for work-related tasks in order to write off the cost.

At the page Based on the miles you drove choose Ill enter my actual expenses. Deducting car loan interest HR Block Lean more about deducting car loan interest with help from the tax experts at HR. When claiming deductions of any kind on your tax returns it is best to keep detailed records and supporting documents that can be used to verify all expenses in case of questions.

Reporting the interest from these loans as a tax deduction is fairly straightforward. Interest on home equity loan s is still deductible but with a big caveat The interest paid on that home equity loan may still be tax deductible in some cases. Most employees cannot deduct car loan interest unless the amount is related to business use.

You cant even deduct depreciation from your business car because thats also factored in. Experts agree that auto loan interest charges arent inherently deductible. This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction.

In order to do this your vehicle needs to fit into one of these IRS categories. A log or record of all trips made in the vehicle for business. Thus as the interest on car loan is allowed to be treated as an expense this reduces the income tax.

If on the other hand the car is used entirely for business purposes the full amount of. Common deductible interest includes that incurred by mortgages student loans and investments. So if you drive your car 50000 miles and 25000 of these miles are for business you can deduct 50 of your car-related expenses including 50 of the interest you pay on your car loan.

But there is one exception to this rule. Typically deducting car loan interest is not allowed. This is because you can only deduct car loans interest for your business.

You cannot deduct the actual car operating costs if you choose the standard mileage rate. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. 10 Interest on Car Loan 10 of Rs.

The interest you pay on student loans and mortgage loans is tax-deductible. If deducting business expenses is new for you make sure to consult with. Not all interest is tax-deductible including that which is associated with credit cards and auto loans.

Car loan interest is tax deductible if its a business vehicle. The standard mileage rate already factors in costs like gas taxes and insurance. You can only claim deductions for the time you drive for Uber.

You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions.

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Tax Prep Checklist

Is Car Loan Interest Tax Deductible In Canada

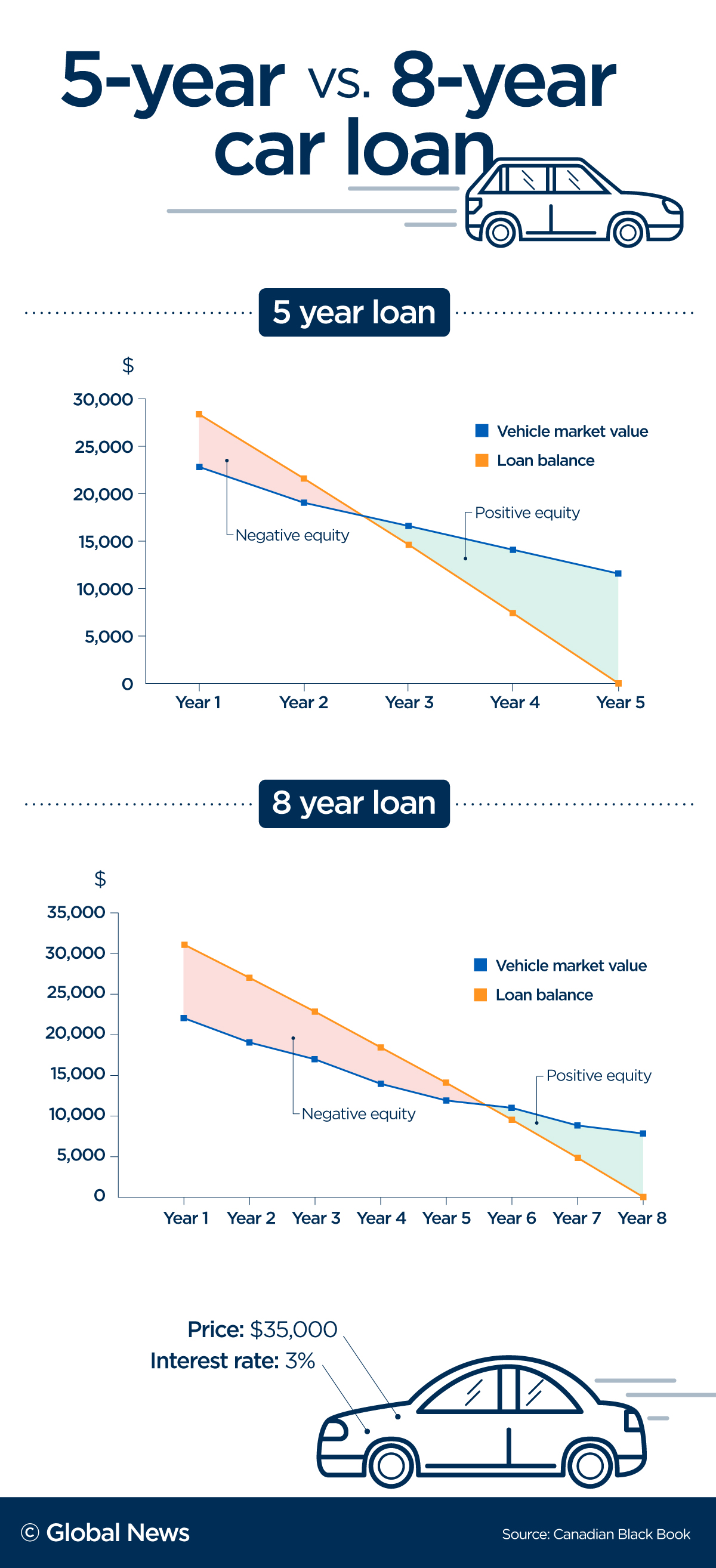

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

How To Secure A Low Rate Car Loan Car Loans Car Finance Financial Tips

Deduction Under Section 80 Eeb Of Income Tax Act Online Taxes File Taxes Online Income Tax

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Income Tax

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

Mortgage Tax Deduction Calculator Freeandclear Tax Deductions Mortgage Mortgage Tips

Shopping For A New Car Want A Better Idea Of What You Ll Be Paying For Your New Car Every Month Use Our Auto Loa Car Loan Calculator Car Loans Car Buying

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Bookkeeping Business Small Business Planner Small Business Plan

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

How To Buy A Car Under A Business Name Car Buying Business Names Business

Why Choose Shorter Tenure On Car Loan Car Loans Loan Car

Buy Your Own House In 2020 Investing Tax Deductions Home Loans

First Time Home Buyers Nikitas Kouimanis Mr Mortgage Fha Va Loans Real Estate Checklist Real Estate Marketing Real Estate Career

Simple Way To Play Tidal Music In Your Car Music In Cars Cars Music Apple Car Play Toy Car

How Does Car Loan Interest Work Bmo

What Is The Average Car Loan Interest Rate In Canada Loans Canada